This detailed breakdown helps in understanding the financial performance of individual products or services. Contribution margin is the amount of sales left over to contribute to fixed cost and profit. Contribution margin can be expressed in a number of different ways, including per unit and as a percentage of sales (called the contribution margin ratio). In the contribution margin income statement, we calculate total contribution margin by subtracting variable costs from sales.

A contribution margin is a narrow view of a product or service’s profitability, but the net profit is a much wider and more comprehensive look at a company’s financial performance. An income statement would have a much more detailed breakdown of the variable and fixed expenses. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold.

- Throw out what you know about the traditional income statement when doing the contribution margin income statement.

- However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases.

- Contribution margin is the amount of sales left over to contribute to fixed cost and profit.

- Since 2014, she has helped over one million students succeed in their accounting classes.

- You don’t need to spend this money to create the product, but it is still included in the cost of making a sale.

Contribution Margin is an important element of understanding the profitability of the products in your business. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process. For that, you’ll need a tool that automates data collection, accurately calculates financial insights, and produces customizable reports. Request a free demo and see how Cube can help you save time with all your contribution margin income statements, reports, analysis, and planning.

How do you calculate EBIT and EBITDA on an income statement?

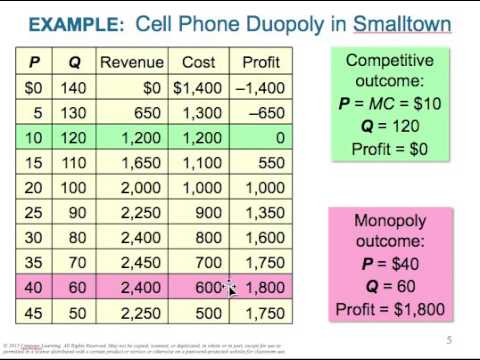

Add fixed overhead and fixed selling and administrative to calculate total fixed cost. For example, if your product revenue was $500,000 and total variable expenses were $250,000, your contribution margin would be $250,000 ÷ $500,000, or 50%. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. This gives a much more detailed financial picture of the business’s operating costs and how well the products perform.

Contribution Margin: What It Is, How to Calculate It, and Why You Need It

The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. Remember the format and ignore the traditional (absorption) income statement. Most students that have trouble with this statement try to relate it back to what is happening on the traditional income statement. Throw out what you know about the traditional income statement when doing the contribution margin income statement. Fixed costs are costs that may change over time, but they are not related to the output levels.

Depending on the type of business, either EBIT or EBITDA can be a better measure of the company’s profitability. Taxes and other company expenses can obscure how well a company’s products or services perform. This makes the EBITDA figure comprehensive income meaning important for investors looking to put money into a business.

Important NoticeThe information contained in this article is general in nature and you should consider whether the information is appropriate to your needs. Legal and other matters referred to in this article are of a general nature only and are based on Deputy’s interpretation of laws existing at the time and should not be relied on in place of professional advice. One challenge that may not be highlighted by using this financial analysis is how much resource is required to produce the product. Normally you will want your product to have a contribution margin as high as possible. However a low contribution margin product may be deemed as a sufficient outcome if it uses very little resources of the company to produce and is a high volume sale product. Variable costs are all the direct costs that contribute to producing that delicious cup of coffee for the customer.

An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future. To calculate the contribution margin, you need more detailed financial data to calculate EBIT. EBIT provides an overall view of the company’s profitability level, whereas contribution margin looks at the profitability of each individual service or product. The contribution margin provides the profitability of each individual dish at a restaurant, whereas income would look at the entire restaurant’s overall financial health. To get the contribution margin, you subtract these costs from the product’s revenue.

How to Improve Contribution Margin

To explore this further, let’s use an example of your local cafe trying to measure the contribution margin of a cup of coffee for the month of March. It sounds like some technical jargon that your accountant may throw at you, but it’s actually quite simple to measure and understand. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

First, fixed production costs are aggregated lower in the income statement, after the contribution margin. Second, variable selling and administrative expenses are grouped with variable production costs, so that they are part of the calculation of the contribution margin. And finally, the gross margin is replaced in the statement by the contribution margin. The variable costs (raw materials, packaging, commissions) total $50,000, leaving a contribution margin of $50,000. After covering fixed expenses (rent, salaries), the net profit is $25,000.

Here, we are calculating the CM on a per-unit basis, but the same values would be obtained if we had used the total figures instead. Reducing cost can be the most difficult option as it will most likely mean labor reduction or negotiating to spend less with your suppliers. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Join our free and exclusive Slack community for professionals just like you. Join our exclusive, free Slack community for strategic finance professionals like you.

The fixed production costs were $3,000, and fixed selling and administrative costs were $50,000. Variable production costs were $1,000 per unit, and variable selling and administrative costs were $500 per unit. This covers the product costs, but remember we must include all the variable costs. Multiply the total variable cost per unit by the number of units sold.

As shown in the formula above, the formula for EBIT involves taking company sales revenue, and expenses, without breaking this down into individual products or services. It’s important to note this is a very simplified look at a contribution margin income statement format. If we subtract the variable costs from the revenue, we’re left with a $22,000 contribution margin.

Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount. Then, further fixed expenses are deducted from the contribution to get the net profit/loss of the business entity. A contribution margin income statement deducts variable expenses from sales and arrives at a contribution margin. Fixed expenses are then subtracted to arrive at the net profit or loss for the period. In its simplest form, a contribution margin is the price of a specific product minus the variable costs of producing the item. What’s left is the contribution margin, which gives a sense of how much is left over to cover fixed expenses and make a profit.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) measures a company’s financial health. EBITDA focuses on operating expenses and removes the effects of financing, accounting, and tax decisions. EBIT features in a company income statement as it gives the operating figures of a business more context. Getting this calculation right can be time-consuming and relies sick pay from day one for those affected by coronavirus on consistent reporting for fixed and variable earnings.